SNAP Q42021 Earnings Note – TheEsotericRunner UT Fund

I had the chance to read SNAP ER and the mood was night and day to FB’s. The big story is that SNAP is claiming that they have mitigated the impact of IDFA policy for the majority of their business by focusing more on the mid-level of the advertising funnel (clicks/installs rather than purchases from ads). SNAP also relies less heavily on SMBs as its source of revenue, and FB admitted that it is easier to come up with custom IDFA workarounds for larger advertisers which seems to be the case for SNAP. Finally, SNAP is able to learn more about their users based on the large variety of ads they allow them to interact with on the platform and improve targeting from information within.

That being said, SNAP’s ARPU was never near FB’s level of monetization (roughly 25% of FB’s) so it makes sense that they are impacted less and the downgrade in accuracy/conversions is less impactful for SNAP. Also, IDFA solutions are enabled for about 75% of their advertisers so those still impacted will still feel the effects for “a couple of quarters”.

User growth remains relatively strong, with NA DAU’s up 6% vs. FB’s down 6% in the last quarter. SNAP is focusing on the rest of the world for growth with 41% YoY DAU growth internationally. This marks the fifth consecutive quarter of 20% YoY DAU growth for SNAP.

In terms of engagement, Stories remains SNAP’s main revenue and growth driver. Mgmt reported that people are posting/watching stories from friends less (possibly due to Covid), but watching premium content more. So it seems like SNAP is pivoting away from a communications business to a media/advertising business and augmented reality business (“where a lot of our growth over the long term is unconstrained”) in the long run. However, this will take time with Spotlight, Maps, and AR not yet monetized nor growing as quickly as the rest of the platform. These pivots will come at a cost and should ultimately weigh on the bottom line in the long term.

Regarding the positive FCF in FY 2021 and positive net income in Q42021, it remains to be seen if it is sustainable with not much color provided on it. Profitability was driven by the combination of 18% growth in ARPU, 4% decline in infrastructure spend per DAU, and content spend declining 4% YoY. Content spend should ramp back up in 2022 as SNAP competes with TikTok and invests in content creation and tries to bolster a (relatively) slowly growing Spotlight (TikTok clone).

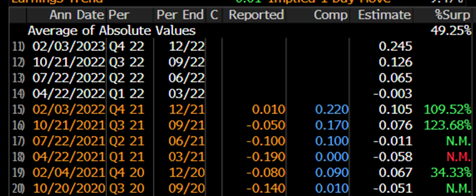

Finally, while net income is a great achievement for the business, it is worth mentioning that positive EPS has been expected for the last 2 quarters: